During economic uncertainty, geopolitical volatility, and rising costs, customer relationships with financial institutions — such as banks, insurers, and wealth managers — are rapidly transforming. Customers are looking to their financial institutions (FSIs) for guidance on navigating the current economic environment. They also want a frictionless hybrid experience, combining both digital and human interactions, proactive outreach, personalized treatment, and an empathetic human touch — and are receiving mixed results.

While macroeconomic volatility persists, technology, such as generative artificial intelligence, has captivated the world. This article looks at the strategies and

challenges taking root amid trends such as the proliferation of customer data and the maturation of artificial intelligence. Discover why customers switch financial services institutions. Learn about what customers look for in a great digital experience. Gain insight on the evolving sentiments on artificial intelligence, cryptocurrency, and consumer brands entering the financial space.

Customers Want Personalized Experiences

Customers are looking to their FSIs for support, advice, and guidance during these uncertain economic times. Seventy-nine percent of customers don’t feel their financial service provider helped them fully prepare for economic uncertainty.

The Importance of Human Interaction

The majority of customers prefer non-digital interactions across all three financial sectors. Over half would switch financial service providers if services felt impersonal.

Trust and Data Security Are Fundamental

Increased awareness of personal data security has made trust between providers and customers more crucial than ever. The majority of customers would share data in exchange for better experiences.

Looking to The Future of Finance

As non-traditional vendors and products become more common, people are more apt to explore (or even switch to) alternative products and providers. Sixty-one percent of customers have either researched or plan to research cryptocurrency

Customer Experience in Financial Services

Rising costs of commodities, increasing interest rates, and turbulence in world events have shaken financial confidence. Increasing prices on everything from food to gas is raising the cost of daily living — and customers’ financial anxiety, leaving people less financially secure than just one year ago.

Only 16% of customers say current macroeconomic conditions and financial market events have not affected their financial strategy.

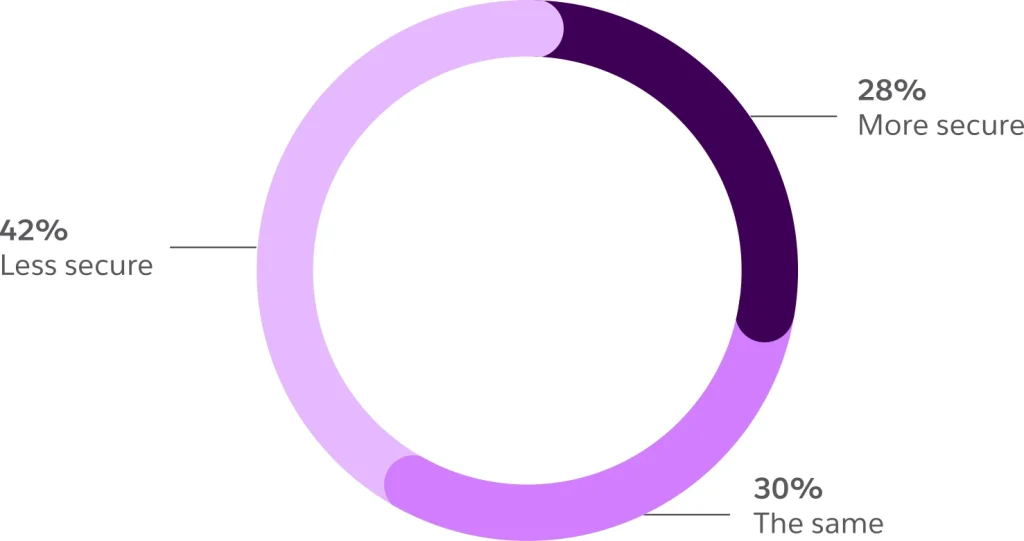

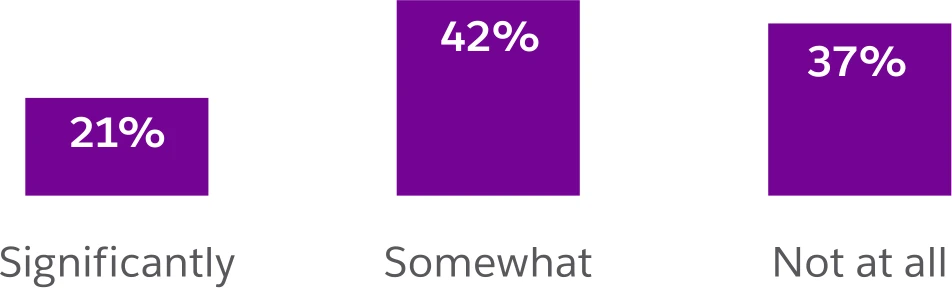

Shake-ups and changes to daily living can be difficult to navigate — especially in uncertain economic times. At the same time, people are turning to their financial institutions for help and guidance, albeit with mixed results. While one in five customers report that their financial institution helped them significantly in preparing for today’s economy, over a third say their financial institution did not help them at all.

Customers Are Feeling Less Financially Secure Compared to One Year Ago

Customers Lack Desired Guidance From Their Financial Providers

Extent to Which Financial Institutions Prepared Customers for Economic Uncertainty

Customers Switch Providers for Better Experiences

Customers want more from their financial institutions and are willing to switch providers to receive a better experience.

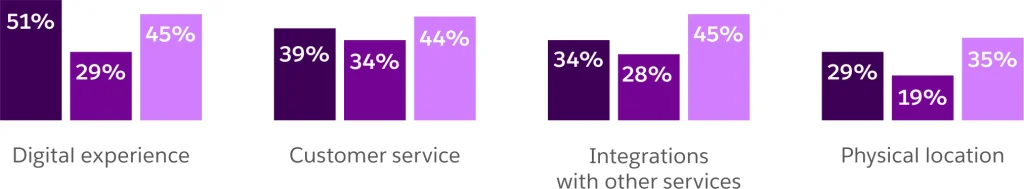

In the past year alone, 25% of customers switched banks, and over a third switched their insurers and wealth managers. Across all three of these financial sectors, the top reason customers give for switching is a desire for a better digital experience. While not as big a factor as digital experience, physical location also compels some customers to switch providers — particularly within wealth management.

Other factors for switching include customer service and a desire for better integration across financial products. Notably, the insurance sector is an outlier in that one in four customers who switched insurance providers say price was the only reason for the change.

Digital Experience Is a Leading Reason for Switching Providers

Costumers Who Switched the Following Providers in the Past Year

Reasons for Switching the Following FSIs

Customers Want More From Digital Financial Experiences

A great digital experience isn’t just nice to have, it’s a necessity. At present, customers indicate that when it comes to the digital experience offered by their FSIs, there’s room for improvement.

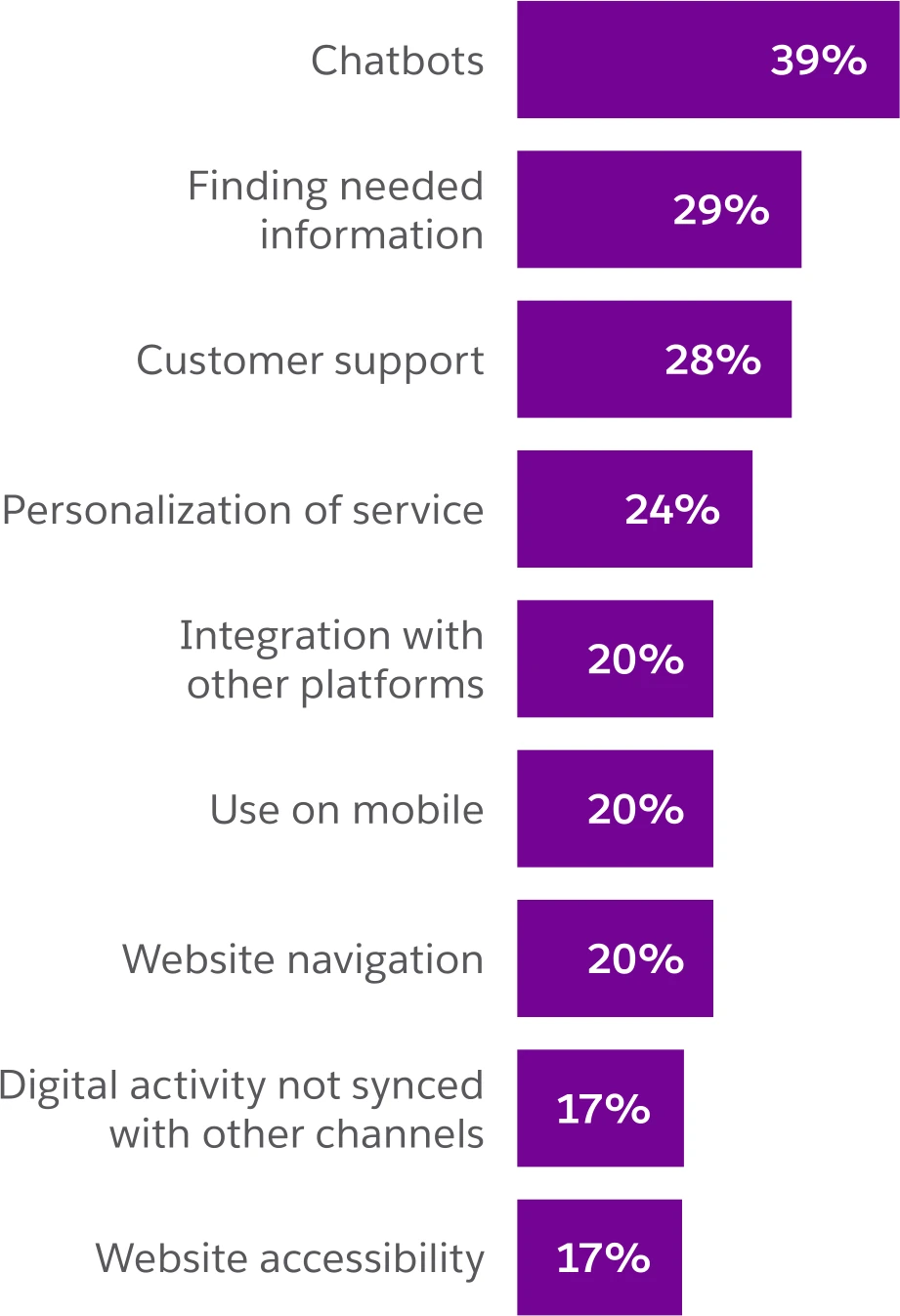

By a sizable margin, poorly integrated non-intelligent chatbots are the most commonly reported area of digital friction. This suggests that, as chatbots are rapidly adopted industry-wide, some implementations fall short of satisfying customer needs.

Other commonly encountered challenges include difficulty finding information online, inconsistent customer service, and impersonal services that make customers feel as if they’re treated like a number rather than a unique individual.

When It Comes to FSI Digital Experience, There Is Room for Improvement

Customers Completely Satisfied with the Following Providers’ Digital Experience

Customers Want More Personalization and Less Friction

Customers Who Find the Following Challenging at Their FSI

A Great Digital Experience Is a Necessity

Customers want and expect to be able to manage a large portion of their financial lives online, especially when it comes to more routine tasks.

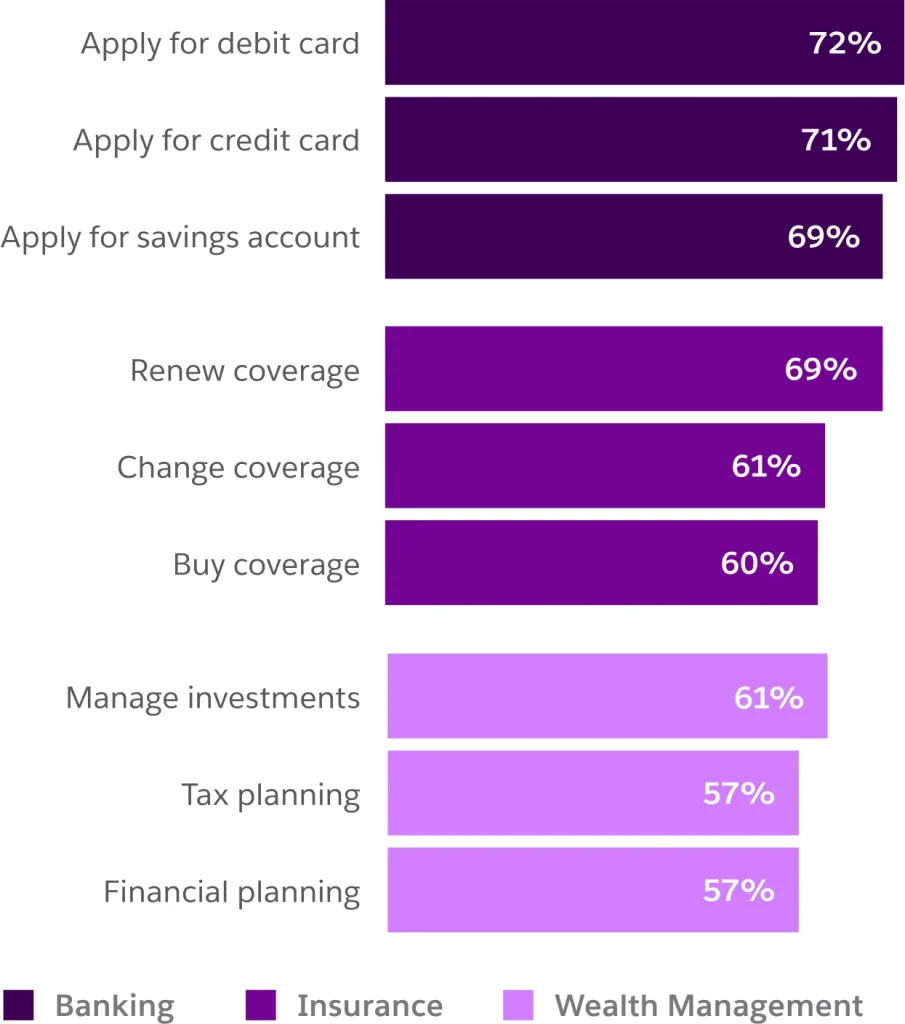

The majority of banking customers want to apply for credit and debit cards and open accounts online. Similarly, insurance customers said they prefer to buy, renew, and change coverage or file claims digitally. And even wealth management clients say they prefer to access routine investment management services and conduct tax and financial planning mostly or completely digitally.

71% of customers want their financial services provider to have a clear digital process for opening an account.

Customers Want to Manage Their Financial Lives Online

Customers Who Prefer to Do the Following Digitally

Customers Expect a Connected, Multichannel Experience

Customers Crave Human Interactions From Their Financial Providers

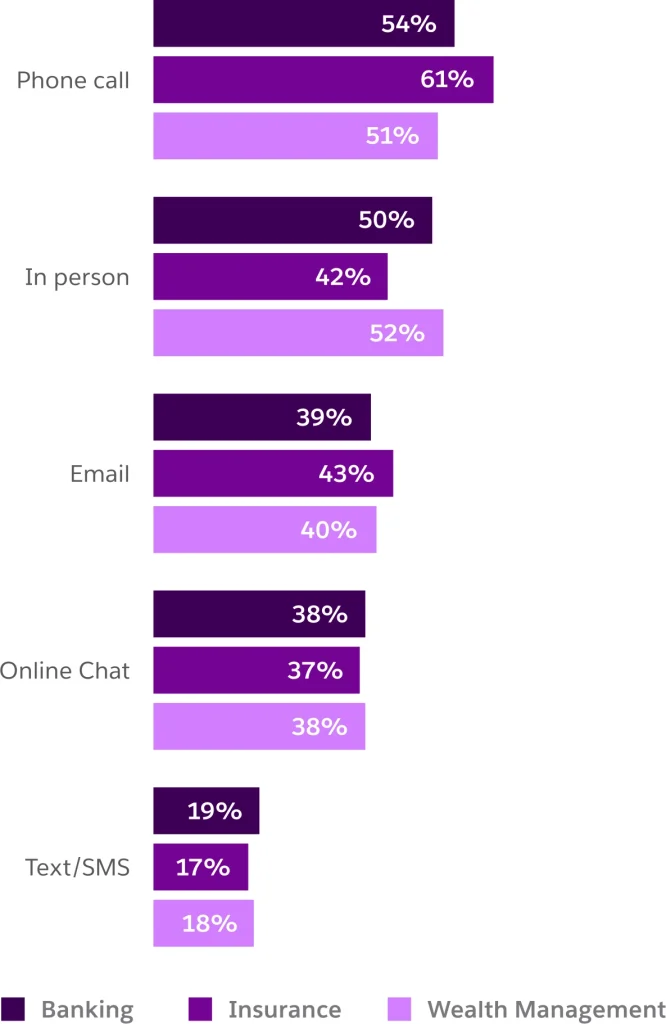

How Customers Prefer to Communicate with Their Financial Providers

Customers interact with their financial service providers across a variety of channels — some digital, some not.

Despite (or perhaps in reaction to) an increasingly digital world, people still crave human, often face-to-face, interaction. The majority of customers prefer nondigital interactions (over digital ones) across all three financial sectors. Banking and wealth management customers prefer to interact in person or by phone, and insurance customers largely prefer to interact by phone.

These preferences suggest a need to feel seen, known, and taken care of. Financial transactions can be complicated, making trust intrinsic to relationships between customers and financial providers. In person and voice-based communications may help people feel they’re getting more “whole-person” individualized service.

Personalization Is a Must-Have for Many Customers

People Want FSIs to Speak to Their Individual Life Circumstances

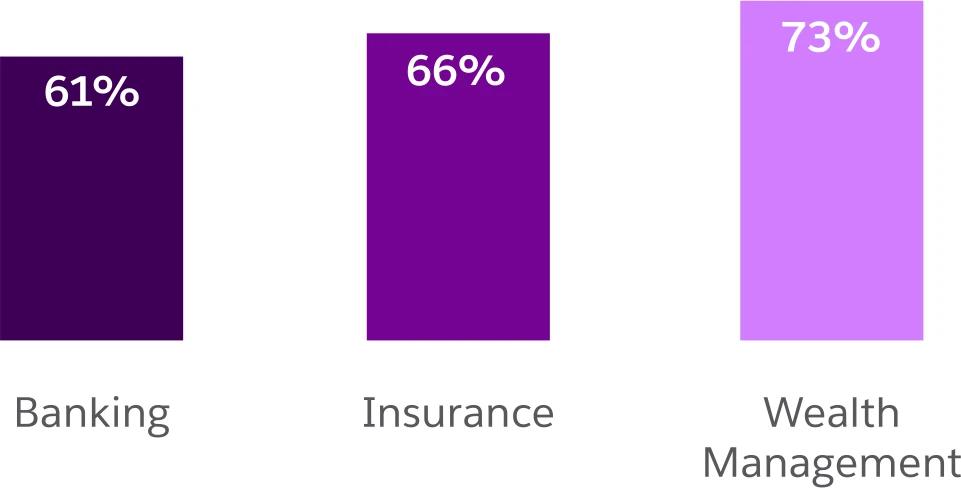

Customers Who Want Personalized Recommendations From the Following

62% of customers would switch FSIs if they felt treated like a number, not a person

53% of customers would switch FSIs if services felt impersonal

73% of customers expect companies to understand their unique needs and expectations — up from 66% in 2020.1

Financial services customers want the companies they do business with to know who they are and what they need. For example, customers purchasing a home want to know their provider is working to get them the best mortgage pre-approval rate. New homeowners may be interested in their insurers’ umbrella policies, while wealth management clients want help planning for life events like college and retirement based on their unique circumstances.

The cost of not providing personalized service is steep, with more than half of customers saying they would switch providers if services were not personalized.

Financial Experiences Sometimes Lack a Sense of Caring

People Crave Empathetic, Human Interactions

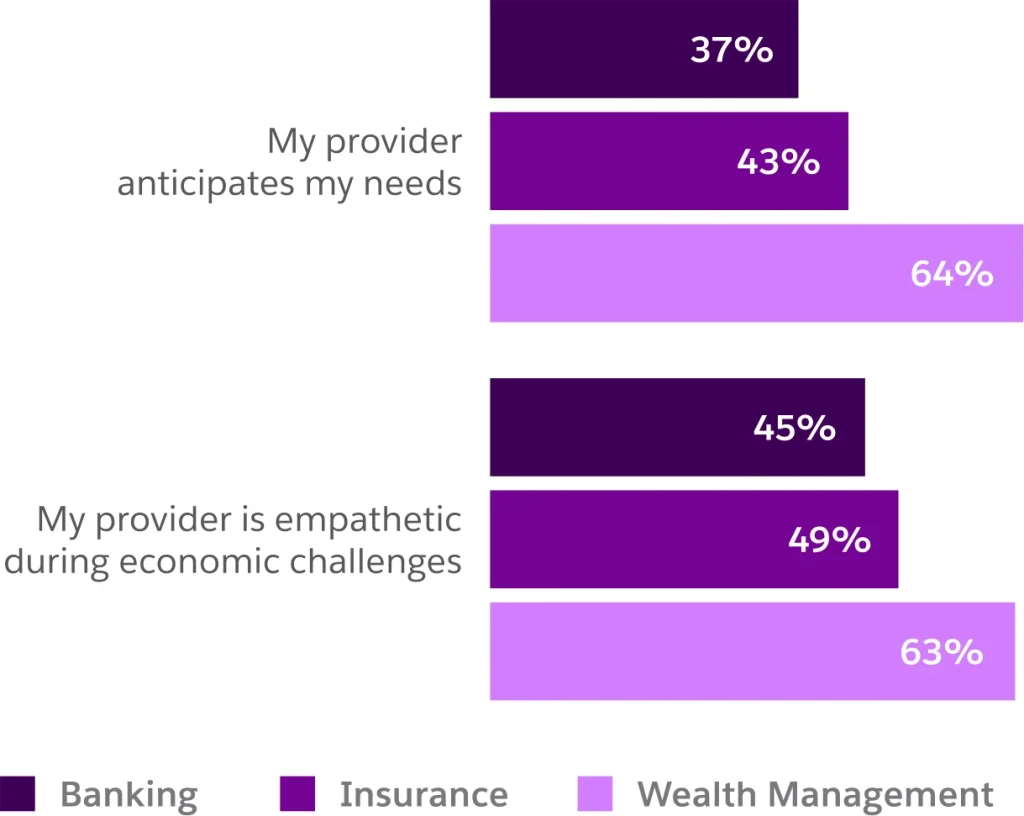

Customers Say the Following

People’s need for attention and care seems to increase in uncertain economic times. Beyond personalized products and services, people want empathetic interactions. They crave a human touch that cannot always be replaced by digital channels. Ultimately, they want to feel like their financial providers care about them.

Perhaps unsurprisingly, customers feel more empathy and care from wealth managers — who work in what’s traditionally thought of as a relationshipdriven sector. They feel less satisfied with banking and insurance providers in these areas. This suggests that banking and insurance providers who find a way to balance their digital offerings with a more human dimension may gain a competitive edge.

Proactive Communication Is Rarer Than Desired

FSIs Fall Short on Proactive Outreach

Customers Who Say This Provider Reaches Out During Challenging Times

42% Banking

49% Insurance

63% Wealth Management

Customers Who Say the Following

77% say I can contact my financial services provider(s) if issues arise

69% say I communicate with my financial services provider(s) through my choice of channel

48% say my financial services provider(s) proactively communicates with me

Customers want proactive and timely communication with personalized services and relevant offers. In the case where an issue arises, it is essential that they are able to easily get in touch with their financial services providers. Fortunately, the majority of customers agree that they can contact their providers when issues arise and that they can do so on their channel of choice.

When significant life events or financial hardships occur, passive communication from financial services providers may not be enough. Instead, proactive communication can send the message that providers know them and have their back. While two thirds of wealth management customers agree that they receive proactive outreach, the majority of banking and insurance customers say they do not.

Personalization Desired Despite Complex Feelings About AI

There is a push-pull between customers’ expectations that FSIs provide proactive, personalized service and their comfort level with some aspects of artificial intelligence (AI). In particular, customers feel ambivalent about financial service chatbots powered by generative AI — a newer form of artificial intelligence that generates original content, including text, image, and audio.

A lack of familiarity could underlie some of the doubt. Forty percent of customers neither agree nor disagree that AI will speed up financial transactions — suggesting uncertainty around what the technology may entail. And, among customers who do have an opinion, a much larger share are optimistic about AI’s time-saving potential.

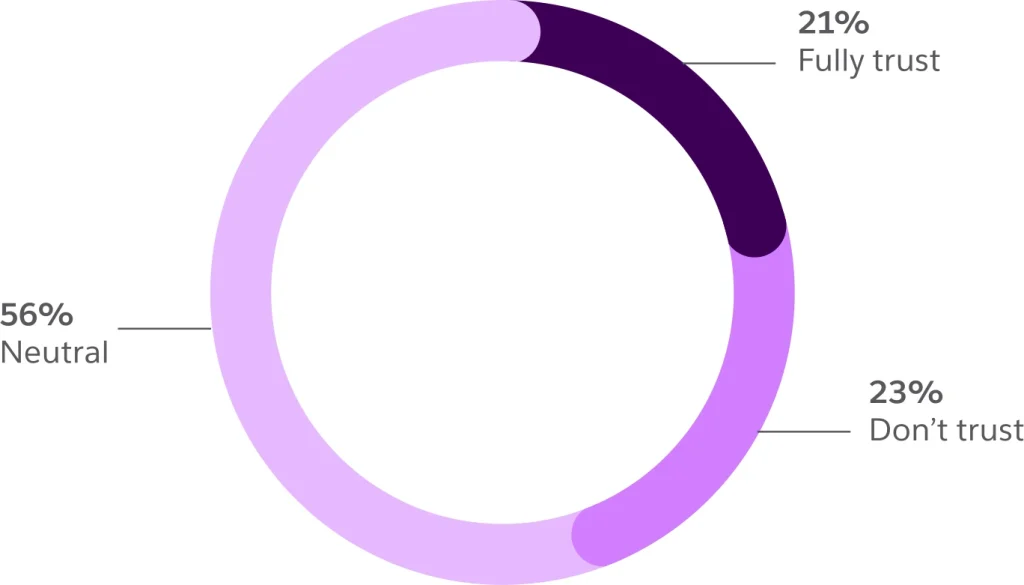

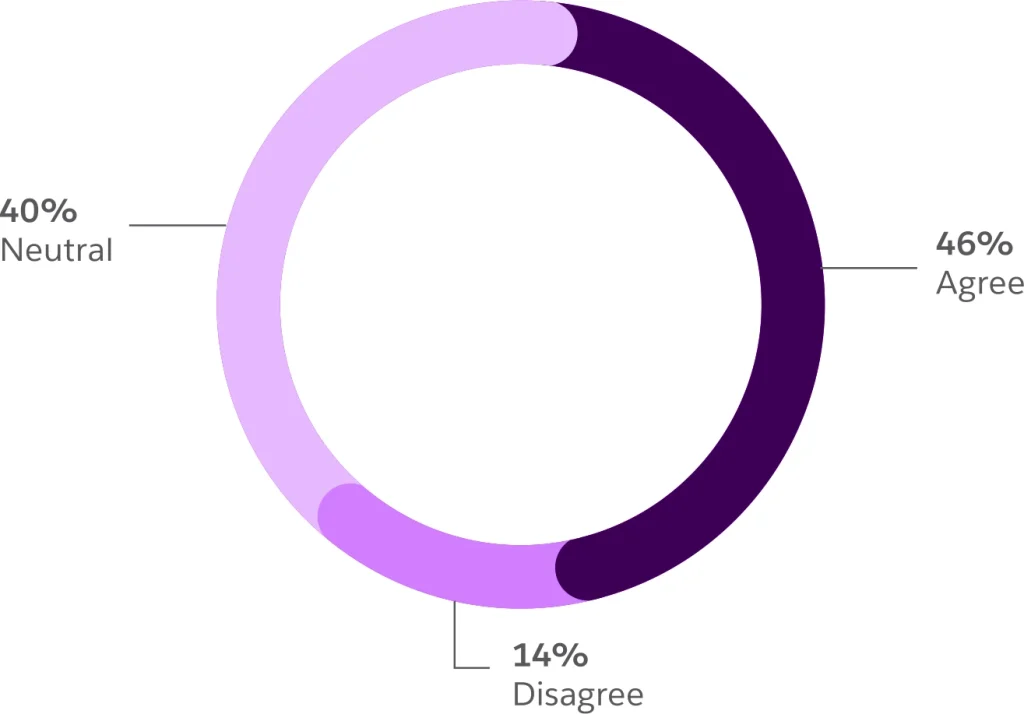

The Majority of Customers Are Unsure They Trust AI

Trust in Generative AI Chatbots in Financial Services

Anticipate That AI Will Speed Up Financial Transactions

In an Era of Cyber Threats, Trust Is More Important Than Ever

Increased awareness of personal data security has made trust between providers and customers more crucial than ever.

Overall, the majority of customers say they have full trust in their providers. However, while overall trust is high, trust around data and data security is more measured. Less than half of customers say they clearly understand how their data is used and/or protected.

This lack of clarity is significant, especially in light of the fact that 78% of customers say they would switch financial service providers if they felt their data was mishandled.

The Majority of Customers Fully Trust Their Financial Service Providers

Customers Who Fully Trust the Following Providers

Banking: 61%

Insurance: 60%

Wealth Management: 68%

Despite High Overall Trust, Trust Around Data Security Is Lukewarm

Customers Who Say the Following

65% say “I trust my financial services providers are compliant with data-sharing regulations”

58% say “I am confident my financial services providers protect me against cyber threats”

50% say “My financial services providers communicate how they protect my data”

48% say “I understand how financial services providers protect my data against cyber threats”

45% say “I understand how financial services providers use my data”

Clear Parameters Increase Comfort With Data Sharing

Data is necessary to help financial services providers personalize experiences, and fortunately, most customers are open to sharing it.

55% of customers are satisfied with how FSIs use their data to provide relevant services — up from 45% in 2022.

Notably, however, customers want a clear and easy-to-understand explanation and a general sense of control over what is shared, how FSIs will use it, and who has access to it. They also want the flexibility to change their minds and opt out, even after previously opting in.

Customers Value Transparency About How Data Is Used

The Following Is Important

82% Control over who accesses my data

82% Control over how my data is used

81% Straightforward terms and conditions

82% Ability to opt out of sharing at any time

80% Ability to review what data is shared

Customers More Willing to Share Data If They Get Something in Return

Customers want providers to treat their data with care — and use it to create more fulfilling, personalized, and relevant experiences and offers.

More than half would share data in exchange for a better overall experience or savings like rate reductions or discounts. And, one in four would be willing to share things like location and movement data in exchange for more personalized service.

However, despite some demonstrated comfort with data-sharing, one-third of customers are still reticent to share any personal information at all.

Majority Are Comfortable Sharing Data in Exchange for Better Experiences…

Customers Who Agree with the Following

56% I would share data with my financial services providers if it improved my experience

55% I would share my data with my financial services provider(s) in exchange for savings

55% I am satisfied with how my financial services provider(s) use my data to offer relevant service

Customers Willing to Share the Following with Their FSI for a More Personalized Experience

29% Wage, W-2, or tax statements

25% Location and movement data

24% Data from health/fitness trackers

24% Social media accounts

33% Media streaming usage

34% None

Consumer Finance in the U.S.

Consumer brands like Apple, Walmart, and Starbucks have expanded their offerings to include financial products — shaking up the field with easier setup, better integration across services, and a more intuitive app and website experience. Curious customers are taking note.

A variety of disruptor companies, like Robinhood, Lemonade, and Rocket Mortgage, have also emerged. These companies offer “friendlier” versions of traditional financial products, prioritizing a robust digital experience that may include engaging social components.

Customers who switched to a non traditional financial provider say they did so due to ease of use, curiosity, and improved integrations with other services they use.

People Are Open to Non-Traditional Finance

41% Would consider opening a bank account with a non-traditional company

34% Would consider buying car insurance from an auto manufacturer

33% Would consider getting wealth management advice from consultants at retail outlets

Customers Who Have Tried the Following Non-Traditional Financial Services

23% Banks

27% Stocks & trading

19% Financial lenders

16% Wealth/asset management

13% Insurance providers

11% Mortgage companies

Reasons Customers Choose Non-Traditional Finance

41% Easy setup/onboarding

35% Curiosity

34% Integration with other services

31% Intuitive app/website

30% Price

30% Bonuses/promotions

28% Data protection

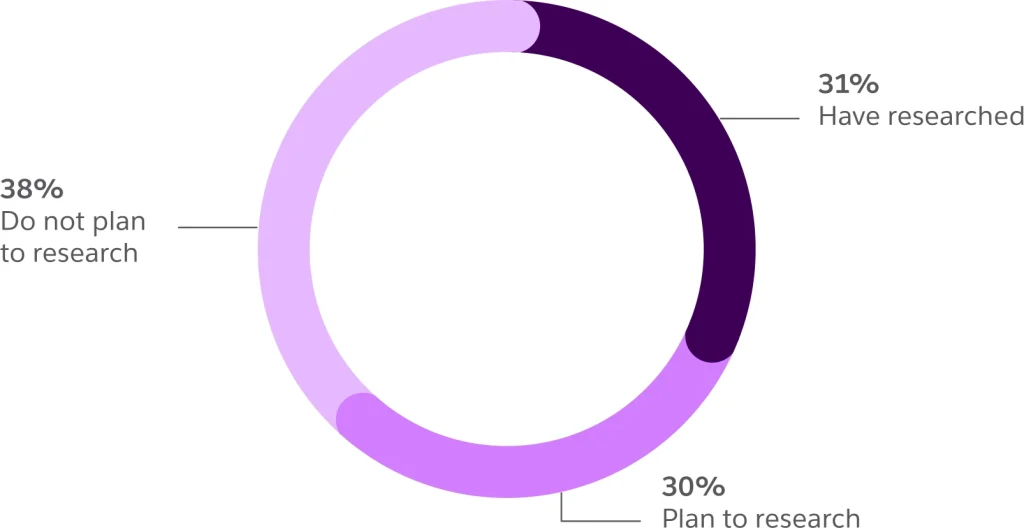

Customer Curiosity for Cryptocurrency

Cryptocurrency Piques Customer Curiosity

Customers Who Have Researched Cryptocurrency

Potential Upsides Stoke Curiosity for Some, but Not All

Factors That Would Increase Comfort with Cryptocurrency

34% Increased transaction security

34% Low cost transactions and payments

26% Fast transactions and settlements

17% Portfolio diversification (i.e., crypto as an asset class)

40% None

Even after the crash in cryptocurrency market, infamously called “the crypto winter,” financial services customers are still curious about digital currency, with two-thirds saying they’ve either researched or plan to research it.

Only 29% of customers want blockchain digital currency services from their FSIs. However, despite this curiosity, only a minority of customers appear ready to take the plunge, with 40% saying they are uncomfortable with cryptocurrency.